Cancelation → Nonpayment

NOTE: See the article here for Voluntary / Insured Requested Cancelations. This article ONLY covers information about nonpay cancelations.

What You'll Learn

What is a non-payment cancelation?

How to process return premium on a non-payment cancelation

Refund process and timeline

Types of Cancelations

Our platform allows two main types of cancelations: voluntary cancelations and nonpayment cancelations. Under all circumstances, funds must be returned to Ascend before any refund can be issued to your client.

This article ONLY covers information about non-pay cancelations. See the article here for Voluntary / Insured Requested Cancelations.

Nonpayment Cancelations

Nonpayment cancelations can occur when the insured has delinquent loan installments. In most states, cancelation for nonpayment occurs when an installment is 15-20 days overdue.

In the event of a nonpayment cancelation, a notice is sent to the MGA to cancel the client's delinquent policies. The client and the account manager on the program are notified of the cancelation via email.

Clients whose policies have been canceled for nonpayment may request reinstatement. This is ideally completed before return premium and/or unearned commission is processed.

When a client's policy is canceled for nonpayment, your company will need to process the cancelation and confirm the cancelation return premium details from the program page. See the steps below regarding this process.

Step-by-step Instructions

Locate the canceled program page

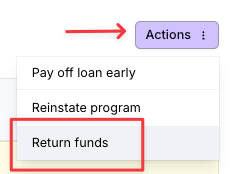

Click the Actions > Return funds buttons

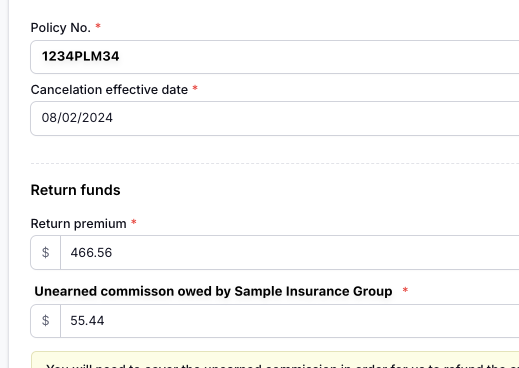

Enter the return premium and unearned commission amounts being returned, and attach a relevant cancelation invoice or endorsement doc

Click Update

Select the payment method to be used for returning RP. Complete transaction.

Next Steps: Collecting Unearned Commission

The Agency Account will have the ability to login to their Ascend portal and make payment for the unearned commission that they owe to the MGA/Wholesaler. This can be found in the Outstanding Balance section.

Refunds

When a financed program is canceled, any amount returned in unearned commission and/or return premium will be applied first to the insured's loan balance, and then a refund will be processed where applicable.

If there are leftover funds after fulfilling the loan balance, all remaining amounts will be issued as a refund to the insured via check to the address listed on the insured details on the program page.

If the return premium and unearned commission do not fully cover the remaining loan balance, the signor of the Finance Agreement is legally responsible for any remaining balance left on a loan for any reason. Legal action will be pursued if the signor of the Premium Finance Agreement does not pay off loan balances within the time given.

Frequently Asked Questions

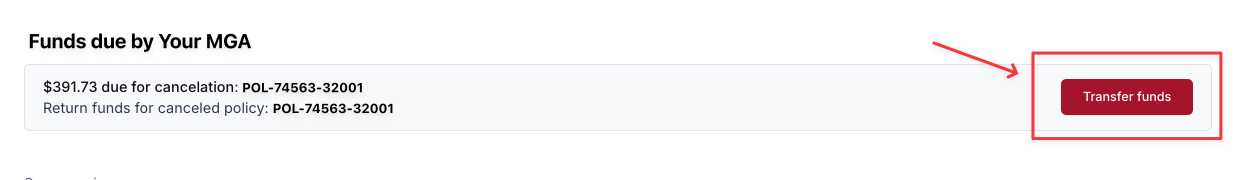

How does my company send Return Premium back to Ascend?

If the RP is not paid at the same time that the endorsement is created, you will see a Transfer Funds link at the top of the program page. Please use this link to transfer the funds for the premium-reducing endorsement back to Ascend.

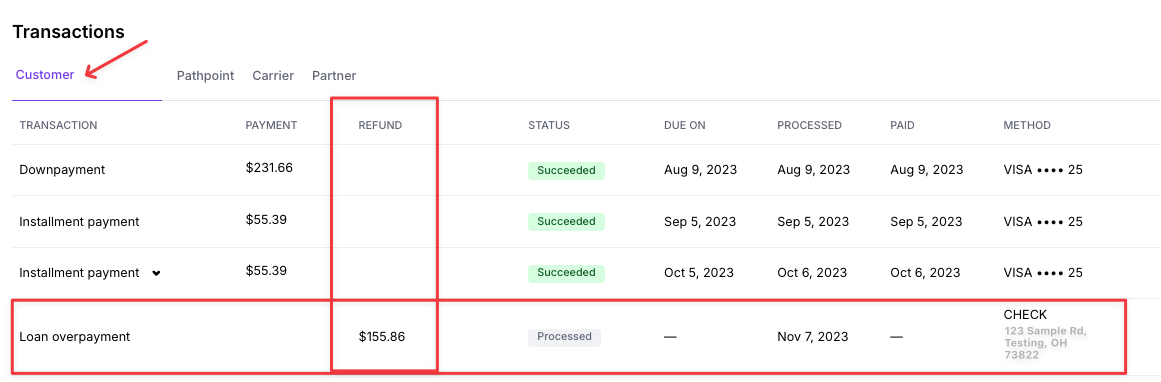

Where can I locate the refund details?

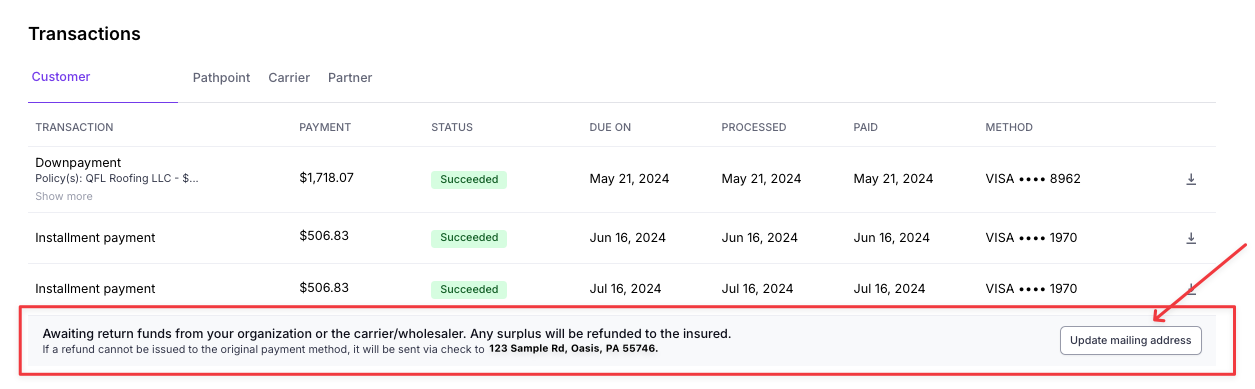

The refund details are visible on the program page's Transactions table under the Customer tab. There will be a Refund column and row:

How do I change the address where the refund will be mailed?

If a refund check has already been sent out, please contact the Ascend Support Team at support@useascend.com for assistance with stop-paying and re-issuing a check.

If a refund check has NOT yet been sent out, the address can be updated from the program page's Transactions section, by clicking the Update mailing address button:

What happens if the insured does not pay for the remaining loan balances on a canceled program?

The signor of the Finance Agreement is legally responsible for any remaining balance left on a loan for any reason. Legal action will be pursued if the signor of the Premium Finance Agreement does not pay off loan balances within the time given.

Can Ascend backdate a cancelation?

For policies canceled for nonpayment, the cancelation date cannot be adjusted.

Contact Us

Need more help? Contact us at support@useascend.com for more help.