Cancelations and Refunds

What You'll Learn

How to process a cancelation

Refund process and timeline

Types of Cancelations

Our platform allows two main types of cancelations: voluntary cancelations and nonpayment cancelations. Under all circumstances, funds must be returned to Ascend before any refund can be issued to your client.

Voluntary Cancelations

Voluntary cancelations occur when the insured requests to cancel their policy for any reason.

Voluntary Cancelations can occur on programs regardless of whether the insured paid in full or financed the premiums at the time of purchase.

⚠️ Ascend does not hold the power to request a voluntary policy cancelation from the Carrier/MGA on behalf of the insured.⚠️

For voluntary cancelations, your agency must first contact the carrier/MGA to notify them of the customer's cancelation request.

Once a policy has been canceled with the Carrier/MGA, your team can process the cancelation within Ascend by following the steps below.

Step-by-Step Instructions for Voluntary Cancelations

Go to the Program Page for the policy to be canceled

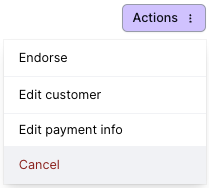

In the Actions menu, select Cancel

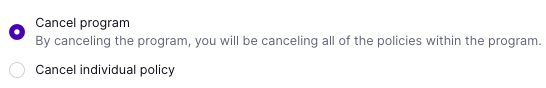

Select the policy or policies to be canceled from the program.

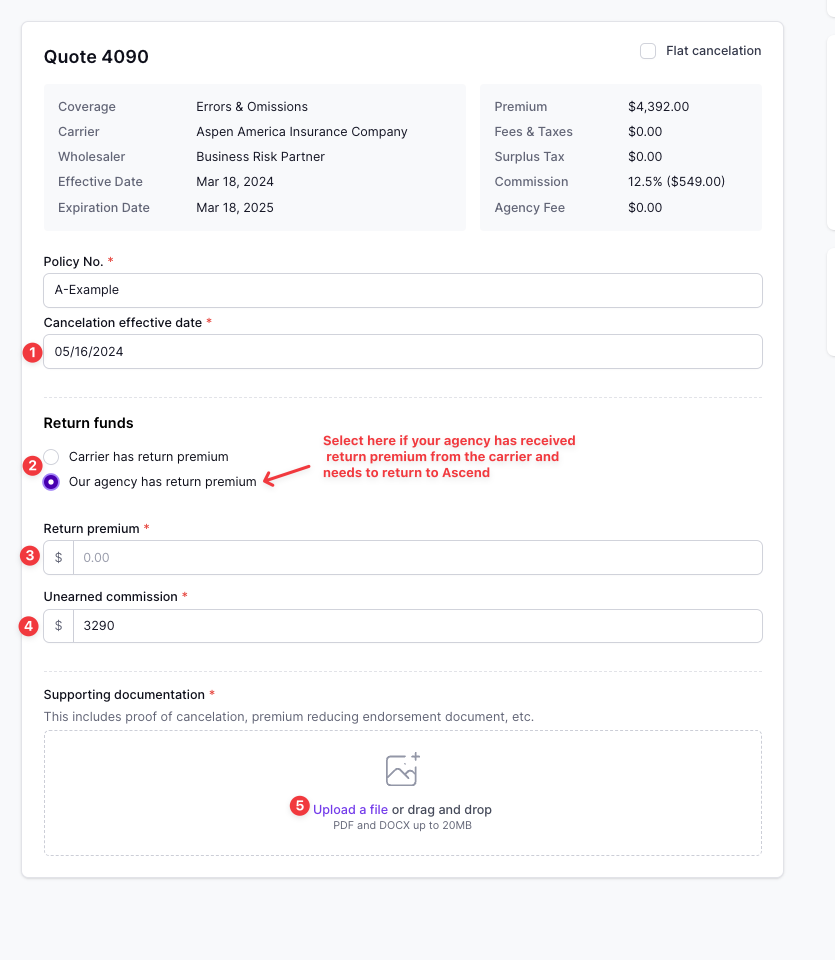

Enter the cancelation details. The cancelation invoice from the Carrier is the most critical document to reference during this step. Please attach the cancelation invoice when canceling a policy.

If your agency HAS received RETURN PREMIUM from the carrier, select the Our agency has return premium bubble and enter the amount to be returned.

When it's finished, please select Confirm Cancelation from the top right corner of the page.

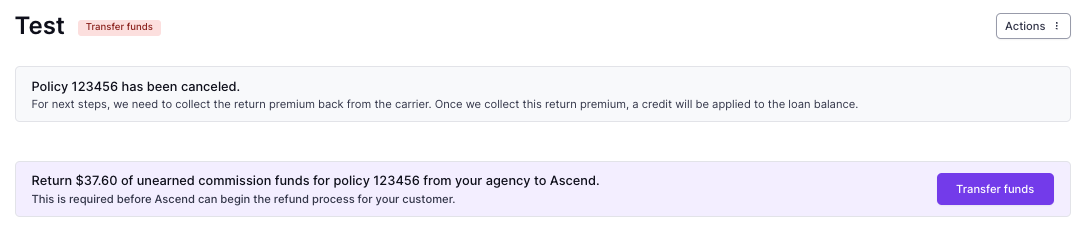

If you entered an unearned commission to be returned through Ascend, a link will be generated for your organization to transfer the unearned commission back to Ascend.

PLEASE NOTE: Some carriers require the unearned commission to be processed through them. Ascend is not responsible for return commission balances between your agency and a carrier. Please check with the Carrier before returning the unearned commission to Ascend.

⚠️ If your team selected Return premium is held by our agency when creating the cancelation, an additional link will be generated to collect return premium funds from your agency.

If that option is not selected, we will assume the Carrier/MGA is returning unearned premium directly to Ascend.

⚠️ Funds should never be returned from your agency directly to the insured to ensure proper compliance and to maintain accounting records for both Ascend and your organization.

Nonpayment Cancelations

Nonpayment cancelations can occur when the insured has delinquent loan installments.

In most states, cancelation for nonpayment occurs when an installment is 15-20 days overdue.

In the event of a nonpayment cancelation, a notice is sent to the Carrier to cancel the client's delinquent policies. The client and the account manager on the program are notified of the cancelation via email.

Clients whose policies have been canceled for nonpayment may request reinstatement. See our article here for reinstatements.

When a client's policy is canceled for nonpayment, a link will be generated for your team to transfer the unearned commission amount back to Ascend after the Carrier sends the return premium.

Refund Timeline and Process for Cancelations

⚠️ Carriers typically take 30-90 days to return funds for canceled policies. Under all circumstances, funds must be returned to Ascend before any refund can be issued to your client.

Any unearned funds for all cancelation types must be returned to Ascend before a refund can be issued to the client.

If the client's policy was financed, all returned funds will be applied towards the client's loan balance, with any remainder being refunded to the client via check after the loan balance is paid off.

Delivery will depend on mail services but generally a week. Sometimes, it can take longer. If your insured reaches out to you after 30 days that they have not received the check AND it hasn't been cashed, we will re-issue it upon request. You can do this by contacting support @ useascend.com.

If the returned funds do not fully settle the client's outstanding loan balance, the client will be liable to pay the remainder as dictated in the signed Premium Finance Agreement.

⚠️ Ascend will not release any refund to a client while an outstanding balance is on that client's loan.

⚠️ Once a client's loan balance is fully paid off, any remaining funds will be refunded to the client on the next business day.

Frequently Asked Questions

Can Ascend backdate a cancelation?

Ascend is required to use the same cancellation effective date for the client's policy as the Carrier.

What happens if the insured does not pay for the remaining loan balances on a canceled program?

Legal action will be pursued if the signor of the Premium Finance Agreement does not pay off loan balances within the time given.

Is interest always calculated pro-rata on a cancelation?

No, some states do not legally require interest to be cancelled pro-rata.