Reinstatements

What You'll Learn

How to Create a Reinstatement Link

Reinstatement Timeline

Frequently Asked Questions

How to Create a Reinstatement Link

⚠️ Before requesting a reinstatement via Ascend, please confirm the carrier/MGA will allow reinstatement of the insured's policy without a rewrite.

On the program page for the customer, go to the Actions menu, and select Reinstate program

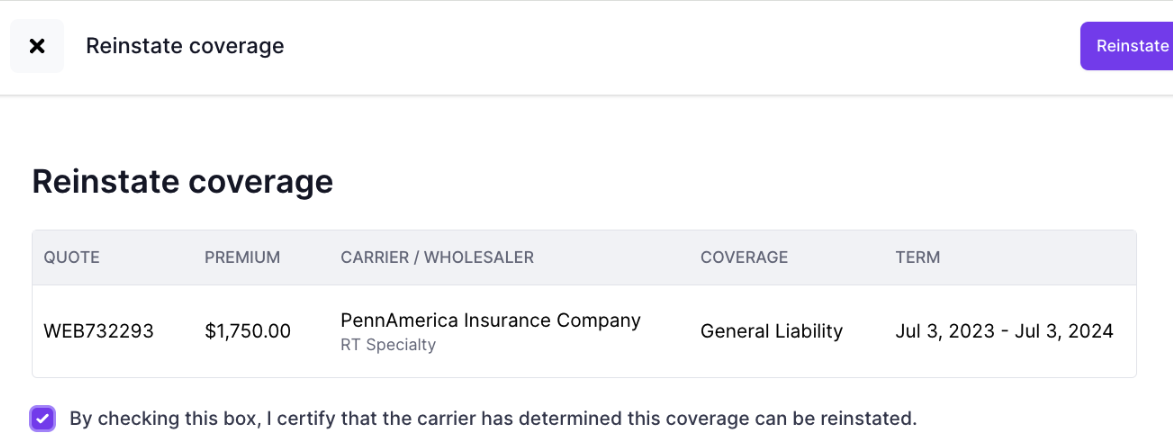

On the following screen, select "By checking this box..." and select Reinstate

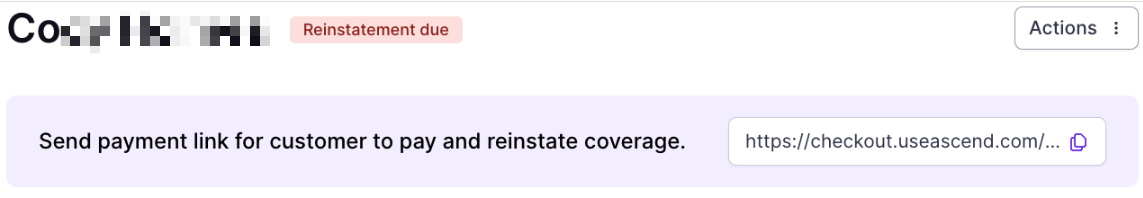

Back on the program screen, the program status will be updated to Reinstatement due and there will be a payment link available to share with your customer.

Copy the payment link and send it to your customer. Please note that the Ascend system does not automatically send the reinstatement link to the customer.

Reinstatement Timeline

⚠️ The reinstatement timeline is affected by your client's payment method. ACH payments take 3-5 business days to process; credit cards process instantly.

For the shortest possible reinstatement timeline, please have your client pay via Credit Card.

Day 0: Client's payment clears to Ascend

Days 1 - 5: Ascend will reinstate the loan

Day 5: Ascend will send reinstatement notice to MGA

⚠️ Please keep in mind, if your client pays via ACH this timeline will be extended by the number of days it takes your client's payment to fully process, typically 3-5 business days.⚠️

Frequently Asked Questions

Can Ascend reinstate a loan more than once?

Yes, as long as the carrier allows.

Why do I have to check with the carrier about accepting policy reinstatement?

Depending on the duration of the lapsed coverage, the carrier may not accept reinstatement for the policy without rewriting the coverage entirely. Rewritten policies will need a new program.

What if the carrier doesn't accept reinstatement without a rewrite?

If the carrier does not accept coverage without a rewrite, Ascend will collect back the unearned premiums and commissions associated with the loan and apply to the outstanding loan balance. Any remaining balance on the loan will be due by your client. Conversely, any leftover funds after the loan balance is completely paid off will be refunded to your client.

How do I know if a reinstatement was rejected?

We will notify you by email after the carrier has processed the rejection. This will result in a cancellation of the loan.

Where can I get a copy of the reinstatement documents?

Please reach out to support@useacend.com to get a copy of reinstatement documents.

Can the client pay part of their overdue payments to be reinstated?

No, all the overdue payments must be received by Ascend in order to reinstate the loan and policy. Reinstatement payments cannot be split up or paid using multiple payment methods.

Contact Us

Need more help? Contact us at support@useascend.com for more help.

-