Request Loan Terms

only applicable to financed programs for Direct Bill policies.

What You'll Learn

What terms can be requested & what's required

How to request loan terms from the Underwriting team

Adjusted Loan Terms

The loan terms that are able to be adjusted include:

1. Number of Installments

The following options are available for the number of installments for a one-year policy term the insured would like to set up for loan repayment:

10-pay

9-pay

6-pay

4-pay (quarterly)

2-pay (semi-annual)

Terms that are less than one year will have fewer payment schedule options.

⚠️ Note: APR and downpayment may increase as a result of choosing a lower number of installments. ⚠️

2. Interest Rate

The interest rate on a finance agreement can at times be adjusted within 2 percent of the program's base rate.

If your MGA has a take rate added to the financing option, the take rate will be removed first when lowering the interest rate. This means your company may not receive take rate, or will receive lower take rate, if the interest rate is reduced on a program.

For more information about the difference between APR and interest rate, check out the article here.

3. Downpayment

Downpayment can be both increased and decreased on a program. Outside of a few coverage types, our standard downpayment is 20% of premium + unearned fees.

Lowering the downpayment on a program will always require review by our Underwriting Team.

Reviews are typically completed within 1 business day, unless additional information is required to complete the review.

Is my program eligible for modified loan terms?

To request reduced downpayment, the program must have at least $10,000 in gross premium. Programs lower the this amount will not be eligible for modification.

Step-by-Step Instructions

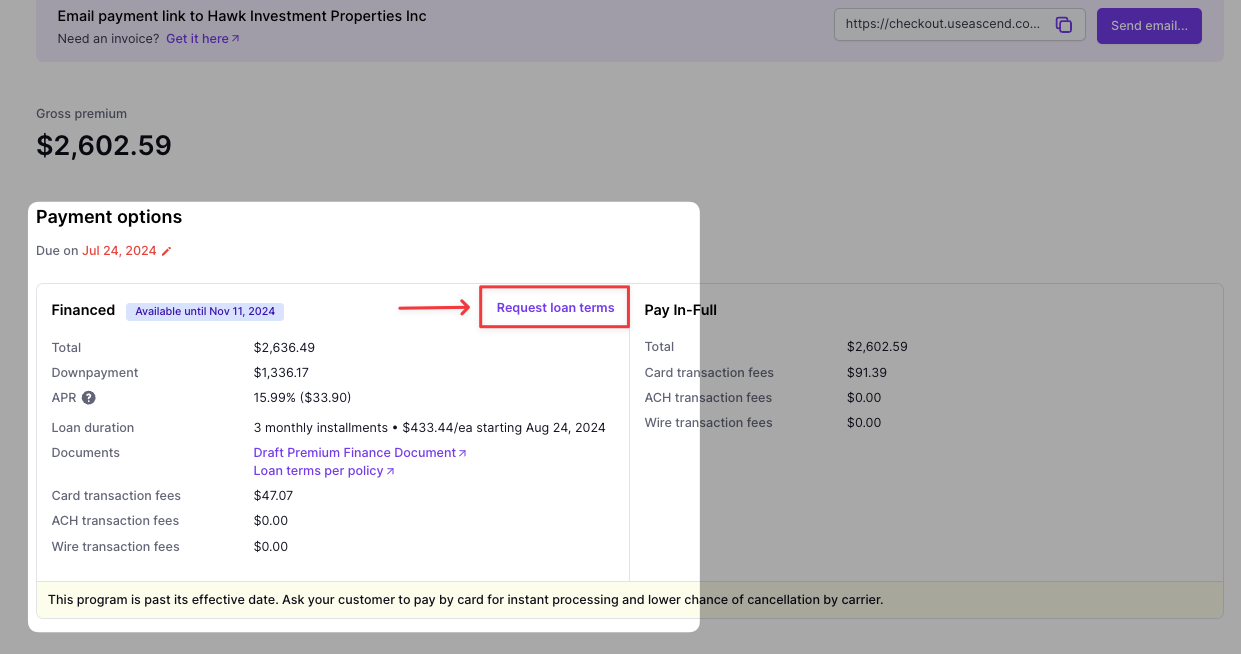

From the program page, click the Request loan terms button under the Payment options section

Make the desired updates on the fields you want to change and upload any required quote documents.

DOWNPAYMENT: Lowering the downpayment on a program will always require review by our Underwriting Team.

Downpayment can only be lowered on programs with greater than $10,000 in gross premium.

You'll receive an email from our system when the request is sent and when the request is completed. Please be sure that the quote and/or invoice docs are attached when requesting lowered downpayment

APR: The APR on a finance agreement can at times be adjusted within 2 percent of the program's base rate. You can also remove your organization's take rate from this view.

PAYMENT TERMS: Select from the drop-down.

PLEASE NOTE: Quarterly and semi-annual payment plans require a higher down payment, which will automatically be updated.

Frequently Asked Questions

How long does it take for an Underwriting Request to be reviewed for lowered downpayment?

Requests are typically processed within 1 business day.

Can I change the payment schedule for an Active Program?

If the insured has already purchased their program, the monthly payment schedule cannot be changed. The payment schedule can only be changed before the customer purchases the policies.

Why does changing the number of payments increase downpayment?

For quarterly and semiannual payment plans, the downpayment will be increased to 35% and 45% respectively to meet underwriting requirements. Due to the longer periods of time in between receiving payment from the insured, the risk on the loan is increased, which requires higher downpayment.

Contact Us

Need more help? Contact us at support@useascend.com for more help.