Disputed Charges

What You'll Learn

What is a dispute/chargeback?

The dispute process

Withdrawing disputes

Refunds on programs with disputed payments

What is a Dispute?

A dispute (also known as a chargeback) occurs when a cardholder questions your payment with their card issuer. The card issuer creates a formal dispute, which immediately puts a freeze on the payment. For example if the insured disputes a monthly invoice for a financed policy, then that invoice is not applied to the loan balance while the dispute is in review.

⚠️ Please note that the entire lifecycle of a dispute, from initiation to the final decision from the bank, can take as long as 2-3 months to complete.

Ascend cannot speed this up, as the customer's card company or bank enacts the timeline.

Common Reasons for Disputes include:

The payor wants to cancel the policy

The payor's payment method was lost or stolen

The payor accidentally disputed the charge

The payor is waiting for a refund

How might a dispute affect the customer?

A dispute filed on an Ascend payment may result in one or more of the following:

A cancellation in coverage due to a break in payments on the insured's loan

A delay or pause on issuing refunds to the customer

Dispute Process

There are three important steps to the dispute process.

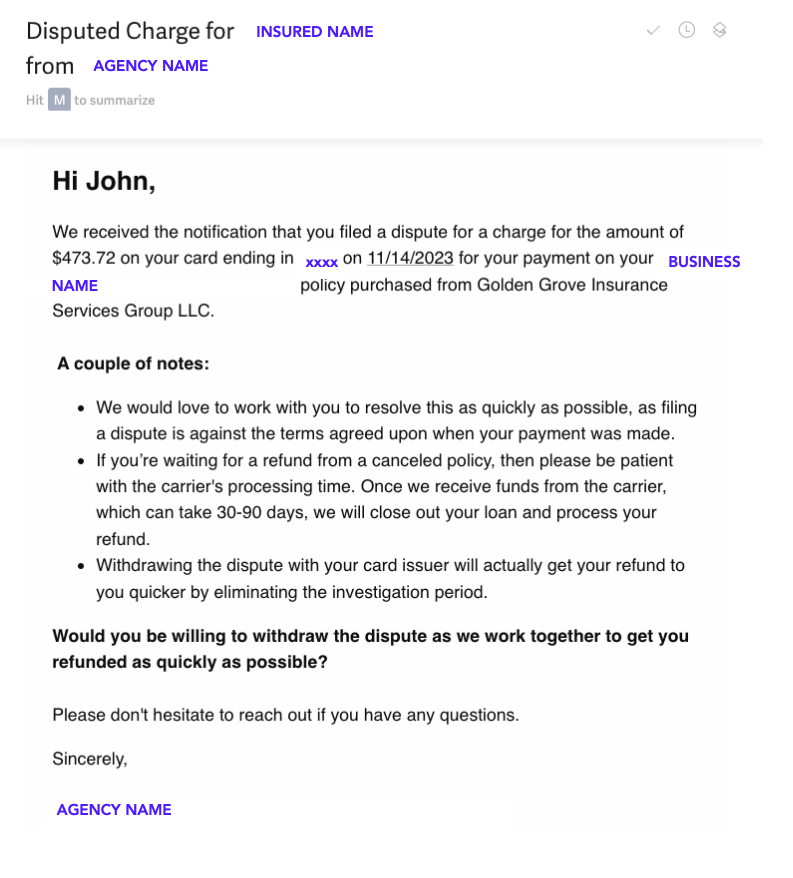

Receive an update about dispute. When a cardholder files a dispute on a payment made through Ascend, our system will immediately notify both the cardholder and the producer on record for the program.

Touch base with the insured and confirm reason for the dispute. When your team is notified about a dispute, your team should immediately touch base with the insured to understand why the dispute was made.

Did the insured dispute the transaction because the policy is cancelled and they want a refund? Your team should make sure that the program is cancelled in Ascend's dashboard (more here) and make sure the insured understands the difference between cancelling a policy vs. the loan they took out to finance the policy. See Disputes on Cancelled Policies section below.

Was the dispute made in error? Collect payment to cover any withheld funds and get proof of withdrawing dispute. See Withdrawing Disputes section below.

Did the insured dispute this charge intentionally? If the insured confirms they will dispute the charge, it's in your interest to show proof that the insured agreed to this charge. See Intentional Disputes section below.

Disputes on Cancelled Policies

What do I do if my insured files a dispute on a canceled policy?

We would love to work with your team to help resolve this for your customer. Here's how you can help expedite the refund process for your insured:

Make sure program is cancelled in the dashboard

Reach out to your customer. They should understand:

If the cardholder wants to cancel a financed insurance policy, then the cardholder must understand that in insurance, premium finance loans are still active until the return premium is received from the carrier/MGA and the loan is closed out. Most refunds will be issued within the 30-60 day timeframe from the date of cancellation and until then the cardholder's loan is active.

Withdrawing disputes will lead to faster refund timing by eliminating the investigation period.

Reach out to the wholesaler/MGA/carrier. You can let them know that the insured has a loan active until the return premium (RP) is sent and request details about the RP issuance date and amount.

Ascend cannot process any refunds on a program with an active dispute.

How does Ascend determine cancellation effective dates?

Ascend bases our cancellation dates directly on the carrier's cancellation date--this is not Ascend's decision. If the carrier has canceled the policy effective 2/1, for example, we should receive the return premium enough to provide the customer a refund for their policy in accordance with that amount. Ascend receives the cancellation return premium from the carrier and applies it to the customer's loan balance, issuing any leftover funds as a refund to the customer.

If an insured needs to be refunded, a check will be sent to the insured's address on file. If funds are owed back from your agency, such as unearned commissions, Ascend will deduct them from your agency's next payout or send a payment link to return those funds to Ascend.

How long does it take to refund for a cancellation?

Ascend can only process refunds on financed programs once the return premium is received from the carrier/MGA and the loan is closed out. Refunds on financed programs directly depend on the carrier sending the return premium. Most refunds will be issued within the 30-90 day timeframe from the date of cancellation. However, the refund timeline will be extended if the carrier still needs to send the return premium to us within that timeframe.

If your customer has filed a dispute while waiting for a refund on a canceled policy, we will work with them to retract the dispute and contact the carrier directly to speed up the refund process as much as possible. Ascend will not process any refunds on a program with an active dispute.

⚠️ Please note that the full lifecycle of a dispute, from initiation to the final decision from the bank, can take as long as 2-3 months to complete.

Withdrawing Disputes

When the insured wants to withdraw a dispute, there are two steps:

1) Get proof of withdrawing dispute. The cardholder must share proof that they revoked the dispute (e.g. forwarded email or screenshots of their communication with their card issuer) and share with our team. Upon formally withdrawing the dispute, the bank will re-bill the insured's account for the disputed charge and sometimes provide a letter of withdrawal. If they don't receive a physical letter, the cardholder should get a notification electronically either via email or on their associated online account.

**Please send us over a copy of this letter of withdrawal or re-billing statement. This letter of withdrawal or a re-billing statement must be a screenshot of the insured's online banking portal or an image of their paper bank statement.**

We must be able to see the cardholder's name, the last four digits of their card, and the date and the amount of the dispute.

It's okay if the insured prefers to redact any sensitive information.

Any letter of withdrawal must state that the insured dropped or withdrew the dispute.

Any re-billing statement documentation should show the date of the original charge, the date of the conditional credit, and the date in which the credit was reversed.

2) Collect payment for disputed amount. While the dispute is in review, funds are withheld from being applied to a policy. If the insured made the dispute in error or wants to withdraw it to prevent the loan and policy from cancellation, they must make an extra payment for the amount disputed. This is because the review process can take months, even when the dispute is withdrawn. Once the dispute review process is complete, if the insured loses the dispute then we will refund them the extra payment.

Intentional Disputes

If the insured confirms they will dispute the charge, then it is in your team's best interest to provide documentation and past communication with the insured showing approval for the transaction. Note that lost disputes could result in your team being responsible for covering the disputed amount, dispute fee, and transaction fee. Please share any communication that you'd like to be included as evidence in countering the dispute (e.g. screenshots, forwarded emails, text threads, etc.) to support@useascend.com .

Contact Us

Need more help? Contact us at support@useascend.com for more help.